Disclaimer: This is not investment advice – just financial entertainment.

TLDR: These are the four variables to screen to find recession proof stocks according to financial research (e.g., Morningstar)

- 1. Dividend Yield 1% or more

- 2. Low Debt/Equity (preferably less than 1)

- 3. Low Beta (e.g., Beta less than 1)

- 4. High Return on Equity (ROE greater than 10%)

Here’s the video I recorded:

What is a Recession?

A recession is simply a broad, painful slowdown in the economy: falling output, jobs, incomes, production, and sales (that’s how the NBER defines it).

Since 1945 the U.S. has seen 13 recessions, roughly one every six years, usually lasting around 10 months.

Consumer spending makes up about two-thirds of the U.S. economy, so when people cut back, companies tied to “nice-to-have” stuff get hit much harder than those selling necessities.

Interestingly, stocks have still been up on average during recessions, so the question isn’t “stocks or no stocks?” but “which stocks?”.

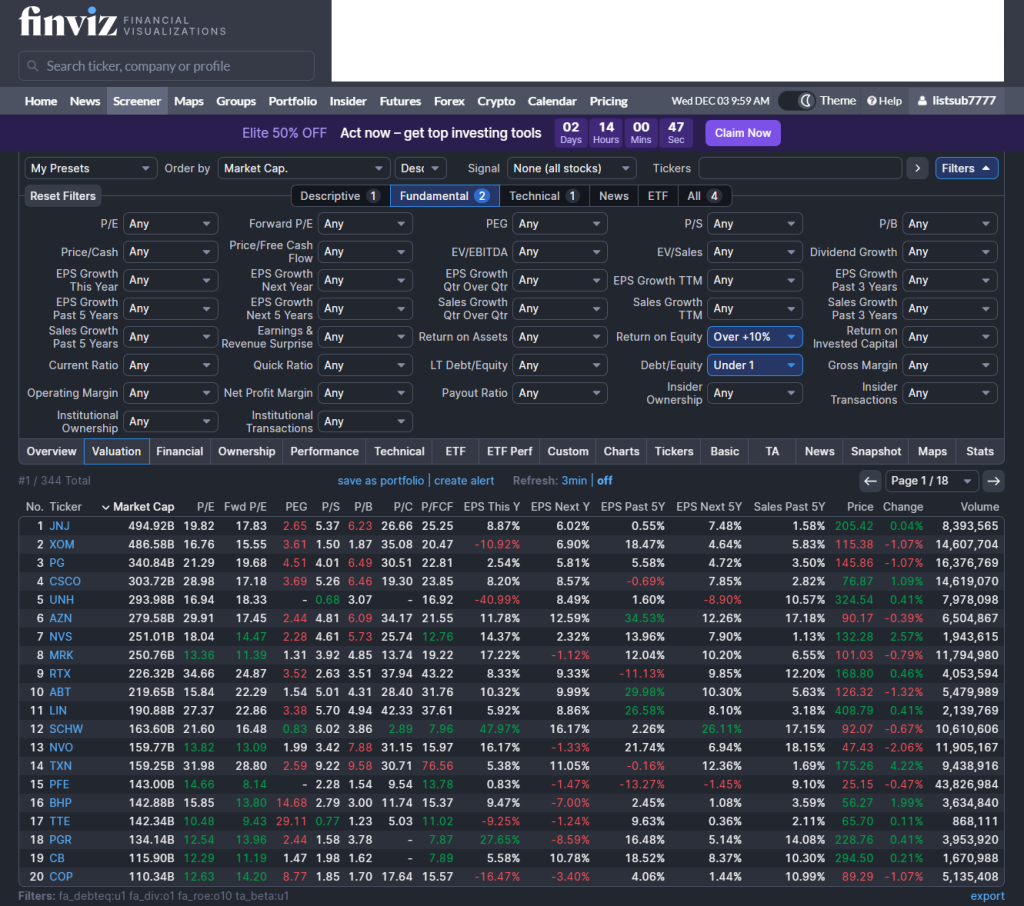

The Finviz Recession Filter Suggested by State-of-the-Art AI Agents

Filter 1 – Dividend yield ≥ 1%

Dividends matter because over long periods a big chunk of stock returns comes from reinvested dividends, not just price moves. Hartford Funds found that since 1960, reinvested dividends made up the majority of the S&P 500’s total return. But chasing super-high yields is dangerous: in 2020, a popular high-dividend index actually fell more than the market because some companies couldn’t keep paying. So in the screener we just ask for a modest dividend (≥ 1%) to find companies that share cash with investors without diving into “desperate high-yield” land.

Filter 2 – Debt-to-equity < 1

In a recession, too much debt can turn a slowdown into a crisis for a company. MIT Sloan research on the Great Recession showed that firms that loaded up on debt before 2008 were forced to cut jobs and close locations far more than low-debt firms. High interest costs plus falling sales is a brutal combo. So we add a simple filter: debt-to-equity below 1, which nudges us toward companies with healthier balance sheets and more breathing room when things get ugly.

Filter 3 – Beta < 1

“Beta” measures how much a stock typically moves compared to the overall market. AllianceBernstein studied global stocks back to the 1970s and found that the least volatile 20% of stocks actually returned about one-third more than the market with roughly 20% less volatility, and they held up better in 7 of the last 8 major downturns. That’s the “lose less in crashes, compound more over time” effect. So we tell the screener: beta under 1, focusing on stocks that historically swing less than the index.

Filter 4 – Return on equity (ROE) > 10%

Return on equity is a simple profitability metric: how much profit a company generates per dollar of shareholder equity. WisdomTree cites research showing that, over almost 60 years, the highest-ROE companies beat the lowest-ROE companies by about 4 percentage points per year on average. High-ROE businesses tend to have strong competitive positions and more resilient earnings. So we add one last filter: ROE above 10% to favor consistently profitable companies that are more likely to sustain dividends and survive downturns.

Also check out my related article:

👉 12 Ways to Make Money with AI

References

NBER recession basics: https://www.nber.org/research/business-cycle-dating

Hartford Funds – 10 Things You Should Know About Recessions: https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/CCWP079.pdf

Hartford Funds dividends/total return (via InvestorPlace summary): https://investorplace.com/2024/01/3-reasons-to-rely-on-dividend-stocks/

MIT Sloan – Corporate debt and layoffs in the Great Recession: https://mitsloan.mit.edu/press/companies-took-more-debt-run-to-great-recession-later-cut-employment-more-sharply-says-new-research-mit-sloans-xavier-giroud

AllianceBernstein – The Paradox of Low-Risk Stocks: https://www.alliancebernstein.com/apac/en/institutions/insights/investment-insights/the-paradox-of-low-risk-stocks-gaining-more-by-losing-less.html

WisdomTree – Why Quality for the Long Run (ROE spread): https://www.wisdomtree.com/investments/blog/2021/08/24/why-quality-for-the-long-run